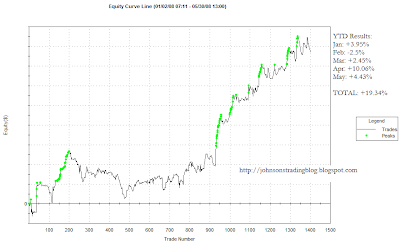

May 2008 Equity Curve:

I've consistently struggled with trading after a run of success. As soon as I get comfortable making money with certain sized trades I inevitably try to ramp up my size, and this of course leads to emotion which does NOT help my returns.

To combat the size problems my goal for June is to start real slow, stay at normal to less than normal sized trades and work my way to a consistent and profitable month with a higher return than the 4.43% I achieved in May.

Some statistics for May:

295 trades, 45.42% of them were profitable

Long trades: 152 trades, 74 profitable for 48.68%

Short trades: 143 trades, 60 profitable for 41.96%

Despite less than 50% of both my long and short trades being profitable in May I found a way to make money both long and short as long trades accounted for 60.4% of my portfolio gains and short trades accounted for 39.6%. Despite the gains my percentage of profitable trades were well below my year to date numbers, especially on the short side (YTD: 53% profitable). This is something I'd like to improve on in June.

YTD Results (through May 31):

Jan: +3.95%

Feb: -2.5%

Mar: +2.45%

Apr: +10.06%

May: +4.43%

TOTAL: +19.34%

Year To Date Chart:

4 comments:

another good month under your belt. nice work bro.

thx stewie - i'm looking forward to when I can make 10% per month consistently.

solid YTD% performance, johnson..

i'm not up nearly what you are for 2008, but find that my equity curves over various timeframes look similar.. periods of chop, then followed by periods of 2nearly straight up.

as a former mentor used to say.. lather, rinse, repeat.

Johnson,congrats on your great performance and fine interview.How much of your success do you attribute to the old cliche of cutting losses and letting profits run?

Thanks,Ron

Post a Comment