I was a chicken these last couple of days and never established a position. Now that DXO has broken out of the declining tops I'll wait for some semblance of a pullback to jump in.

Redirect

Thursday, December 11, 2008

Friday, August 8, 2008

Linda Raschke's Market Thoughts

Click here for the full articleThe Dow, SP, Russell have had well defined downtrends on both the daily and the weekly time frames. Currently, the weekly charts are correcting an oversold condition which should lead to further upside. However, it would take an incredible amount of work to turn the daily time frames, as well as the weekly time frames from downtrends to uptrends. That is unlikely to happen in the next few months, so on these indexes at least, you are still looking at a corrective rally in terms of structure.

Watch to see what type of volume comes in over the next week. Naz has already had a clean upside breakout. So - that is my two cents worth - the market can still have upside potential from here, but much of it is coming from rotation, which never supports a sustainable long term rally.

Friday, August 1, 2008

Wednesday, July 30, 2008

Wednesday, July 2, 2008

Sad Day

The Seattle Sonics are no more. The gutless City of Seattle reached a a settlement this afternoon with the thieves that bought this team from our gutless former owner, Howard Schultz. Ugh.... All we have left now is YouTube highlights of the Reign Man and the Glove.

Tuesday, July 1, 2008

Paul Desmond (Lowry's): "Quite a ways from a bottom"

"We think we're still quite a ways from a bottom," Desmond warns. Over the next year, he expects the Dow to fall 30% to 50% from its October '07 top. The market could enjoy a few short-lived rallies during that span, like the one we experienced from March through May. But each rally is apt to result in a lower high and a lower low in the market.

Desmond is the author of the esteemed Lowry's Report and is someone I go out of my way to listen to.

Below I've attached a chart showing the 30% and 50% retracement levels off of that Oct '07 top.

Thursday, June 26, 2008

T2108 Update

Thankfully, it appears my status as a "Spam Blog" has been removed and I'm free to post to Blogger once again. Though, some of you may think this blog is just as spammy as ever. Ha. Spurred on by Stewie's exuberance here is an update on the Worden TeleChart T2108 indicator.

T2108 is an indicator which tracks the % of stocks that are above their 40 day moving averages. It's worked very well in the past as an indicator that gets you long when everyone else is experiencing maximum amounts of pain. I first picked up on this indicator a few years back when Gary B Smith, formerly of TheStreet.com, would reference it constantly.

We're at 15.00 as of the close today. This is below the levels we hit in Jan and Mar of this year and just above the Nov 07 lows (hit about 13). The Aug 07 lows hit 7.7.

T2108 is an indicator which tracks the % of stocks that are above their 40 day moving averages. It's worked very well in the past as an indicator that gets you long when everyone else is experiencing maximum amounts of pain. I first picked up on this indicator a few years back when Gary B Smith, formerly of TheStreet.com, would reference it constantly.

We're at 15.00 as of the close today. This is below the levels we hit in Jan and Mar of this year and just above the Nov 07 lows (hit about 13). The Aug 07 lows hit 7.7.

Friday, June 20, 2008

T2108 - Oversold Indicator

Thursday, June 19, 2008

GOOG

Wednesday, June 18, 2008

Interesting Note from Hamzei Analytics

"Our Market Pulse Indicator (MPI) is getting ready to setup for a [ROYAL] FLUSH of the weak longs. Once we are thru that painful process, we should be ready for a blast off. The window is 2 to 5 days. Brace Yourself."This and more at their site: Hamzei Analytics

Tuesday, June 17, 2008

Watchlist for 6/18/08

Here is a picture of my watchlist for tomorrow. The flagged stocks are particularly interesting to me.

Solid Day

I've had a pretty good day so I don't have room to complain but it's hard not to wonder what could have been. Check out the list of stocks I had identified for potential buys today and their performance on the day (listed in the sort value column)

I'm currently in some MON, NE and NBL as they are breaking out or looking like they will soon. Oil and Ferts - stick with what is working.

I'm currently in some MON, NE and NBL as they are breaking out or looking like they will soon. Oil and Ferts - stick with what is working.

Monday, June 16, 2008

Setups I'm Watching

Thursday, June 12, 2008

Bo Yoder Update

An update from Bo Yoder today:

This market desperately needs to form a higher low, as any retest of the "peek" double bottom we formed in would be an extraordinarily bearish event.This and more at his very helpful website: The Five Minute Investor with Bo Yoder

Normally, when a breakdown occurs after a "peek" double bottom, prices will fall about as far as they did prior to the bottom's formation. If this projection is made, it would put us at the 1,000 point level for the S&P 500. We have plenty of room for reversal before any breakdown can occur, and I hope that the bulls are interested in defending the bottom in the months to come.

Bounce Near?

Rob Hanna is out with another great post - this time referencing the McClellan Oscillator and what that it is saying about the long side in the comings days / weeks. Well worth your time:

Link: What The McClellan Oscillator Is Suggesting

Link: What The McClellan Oscillator Is Suggesting

Wednesday, June 11, 2008

That Kind of Day - FSLR

Linda Raschke Interview Notes

On June 5 I participated in an interview / conference call with Linda Raschke. Raschke is likely most known for her excellent track record as a short term S&P 500 futures trader. I took some notes during the call and have done my best to make sense of my scribbles below

Two additional sources of great information on Linda can be found here:

1) “Linda Bradford-Raschke’s 5 trading patterns” (PDF document)

2) The New Market Wizards: Conversations with America’s Top Traders by Jack D. Schwager (Amazon Link)

Below are my notes on her thoughts:

WHERE SHE TRADES:

95% of profitability is on futures

Have a game plan before the market opens

ABC setups

120 Minute flags

HOW TO BECOME A PROFESSIONAL TRADER:

1) Practice - similar to golfer or musician

2) Do it, model, after 2-3 years hope to see some improvement and proficiency and find a niche that works for you

3) Make trades. 1 trade, 100 trades, 1000 trades, 5000 trades. After 5000 you should hopefully have a level of proficiency.

FAVORITE BOOKS:

Favorite money management book:

Kenneth Grant - Trading Risk: Enhanced Profitability through Risk Control. (Amazon Link)

Book addresses the importance of maintaining an active trading rhythm - feel it when the door opens and more volume comes in

Favorite other book:

Roy Longstreet - Viewpoints of a Commodity Trader - 2 pages in there are particularly helpful.

90% of the time most professional traders trade with 50% of their line or less.

PSYCHOLOGY:

A) Look into sports psychology books - $20 bucks buys you a great book

B) Emotions - less emotional the better - even temperament - get more even tempered with more experience

The best traders don't beat themselves up and don't let it go to their head if / when they are making big money

THINGS A BEGINNER NEEDS TO DO:

A) Get experience executing - 3 months of practice just getting out in 1 tick. Execution becomes automatic.

B) Newer you are to trading the shorter your holding period should be. The less time you are in the market the less risk you have. Longer you are in a trade the more objectivity you will lose

Could she recommend one strategy for a beginner to start with?

Take 2 time frames - 5 min and 15 minute use the two together and look for a pullback on the 15 min time frame in the direction of the trend but wait for the divergence on the 5 minute to trigger your entry.

Divergence - can give you a level of an absolute stop - shouldn't take out the last high or low. Don't want to fade the trend. Don't short a sell divergence when there are new highs being made daily.

WHAT IS SHE DOING NOW?

1 trick pony - does the same thing over and over but with bigger size. That's really the big secret. Find a niche. Find what you are good at and just learn to do it bigger size.

BOOKS MENTIONED:

Two additional sources of great information on Linda can be found here:

1) “Linda Bradford-Raschke’s 5 trading patterns” (PDF document)

2) The New Market Wizards: Conversations with America’s Top Traders by Jack D. Schwager (Amazon Link)

Below are my notes on her thoughts:

WHERE SHE TRADES:

95% of profitability is on futures

Have a game plan before the market opens

ABC setups

120 Minute flags

HOW TO BECOME A PROFESSIONAL TRADER:

1) Practice - similar to golfer or musician

2) Do it, model, after 2-3 years hope to see some improvement and proficiency and find a niche that works for you

3) Make trades. 1 trade, 100 trades, 1000 trades, 5000 trades. After 5000 you should hopefully have a level of proficiency.

FAVORITE BOOKS:

Favorite money management book:

Kenneth Grant - Trading Risk: Enhanced Profitability through Risk Control. (Amazon Link)

Book addresses the importance of maintaining an active trading rhythm - feel it when the door opens and more volume comes in

Favorite other book:

Roy Longstreet - Viewpoints of a Commodity Trader - 2 pages in there are particularly helpful.

90% of the time most professional traders trade with 50% of their line or less.

PSYCHOLOGY:

A) Look into sports psychology books - $20 bucks buys you a great book

B) Emotions - less emotional the better - even temperament - get more even tempered with more experience

The best traders don't beat themselves up and don't let it go to their head if / when they are making big money

THINGS A BEGINNER NEEDS TO DO:

A) Get experience executing - 3 months of practice just getting out in 1 tick. Execution becomes automatic.

B) Newer you are to trading the shorter your holding period should be. The less time you are in the market the less risk you have. Longer you are in a trade the more objectivity you will lose

Could she recommend one strategy for a beginner to start with?

Take 2 time frames - 5 min and 15 minute use the two together and look for a pullback on the 15 min time frame in the direction of the trend but wait for the divergence on the 5 minute to trigger your entry.

Divergence - can give you a level of an absolute stop - shouldn't take out the last high or low. Don't want to fade the trend. Don't short a sell divergence when there are new highs being made daily.

WHAT IS SHE DOING NOW?

1 trick pony - does the same thing over and over but with bigger size. That's really the big secret. Find a niche. Find what you are good at and just learn to do it bigger size.

BOOKS MENTIONED:

Tuesday, June 10, 2008

Time To Buy the Financials

Maybe. Maybe not. Would certainly be a gutsy trade here.

I have an excellent indicator that is telling me its time to buy them for a trade though. I've been testing a new system that looks to buy and sell Ultra ETF's (2x) based on RSI signals. The basics are that it goes long when RSI(2) hits 10 and sells when RSI(2) hits 80. I've tested the system as a whole with around 50 ETF's that have enough volume and the win rate is incredible.

The UYG (Ultra Financials Proshares) signalled a buy on 6/3/08 at 27.76 and are currently trading at 26.00 even, offering an even greater opportunity to profit than usual. Note below the historical success of trading the UYG based on the system's criteria. Tests were run purchasing an even 10,000 of UYG on every signal. You can see that the system is up around 100% since the first trade was executed in May 07. Pretty impressive considering the system is buying UYG while its fallen from 70+ to 26 today.

I have an excellent indicator that is telling me its time to buy them for a trade though. I've been testing a new system that looks to buy and sell Ultra ETF's (2x) based on RSI signals. The basics are that it goes long when RSI(2) hits 10 and sells when RSI(2) hits 80. I've tested the system as a whole with around 50 ETF's that have enough volume and the win rate is incredible.

The UYG (Ultra Financials Proshares) signalled a buy on 6/3/08 at 27.76 and are currently trading at 26.00 even, offering an even greater opportunity to profit than usual. Note below the historical success of trading the UYG based on the system's criteria. Tests were run purchasing an even 10,000 of UYG on every signal. You can see that the system is up around 100% since the first trade was executed in May 07. Pretty impressive considering the system is buying UYG while its fallen from 70+ to 26 today.

Monday, June 9, 2008

GOOG - Taking what the market is giving me

Nice quick trade for some fast money. Another one of my favorites - very little risk as it was breaking the lows of the day. Cover when you feel the downside slowing. If it were to have turned around just after my short I'd have considered going long as if taking out the lows can't push GOOG down it is likely to head up.

Friday, June 6, 2008

Thursday, June 5, 2008

Two Charts to Rule Them All

Linda Raschke - Live Interview today at 1:30

Found this a few hours ago and thought it sounded interesting so just passing it along. I don't have any association with Rasche or TradingMarkets.com:

Click here to register - it's free

I'm signed up and going to give it a listen. Should be interesting.

Here is Raschke's bio from the site:

Click here to register - it's free

I'm signed up and going to give it a listen. Should be interesting.

Here is Raschke's bio from the site:

For those of you who are not familiar with Linda Raschke’s work, she began her professional trading career in 1981 as a market maker in equity options. Raschke is probably known mostly as a short-term S&P 500 futures trader, but she is active in several time frames, markets and trading styles.

Raschke has been a full-time professional trader for over 20 years. She began her trading career on the Pacific Coast Stock Exchange and later moved to the Philadelphia Stock Exchange. Linda was written up in Jack Schwager's book, The New Market Wizards and in Women of the Street by Sue Herera.

Wednesday, June 4, 2008

Coal

Coal has had a heck of a run here and I'm wondering whether its time to think about getting short.

KOL is holding the trend line and the 21 day mov avg well thus far but the higher volume pullback immediately following a new high is bearish.

PCX has been incredible and I'm embarrassed to say I missed the whole move. Looking at this chart I see no reason to go anywhere near a short on the stock.

KOL is holding the trend line and the 21 day mov avg well thus far but the higher volume pullback immediately following a new high is bearish.

PCX has been incredible and I'm embarrassed to say I missed the whole move. Looking at this chart I see no reason to go anywhere near a short on the stock.

Three great looking stocks

Favorite Trading Sites

I added two new links to my list of "Favorite Trading Sites" tonight:

1) Bulkowski's Blog: Thomas Bulkowski is the author of Encyclopedia of Chart Patterns , Getting Started in Chart Patterns,

, Getting Started in Chart Patterns, as well as a few other books

as well as a few other books . I just recently found his blog and am already a big fan.

. I just recently found his blog and am already a big fan.

2) Dan Zanger's Trader's Nation Weekly Audio Interview: This is an audio interview that is conducted every Wednesday morning with Dan and available all week in an archived form. I find it helpful to refocus my thoughts on the leaders in the market. In today's interview he mentioned AAPL, RIMM, MON, MOS, POT, CF, EXM, DRYS, MA and V.

1) Bulkowski's Blog: Thomas Bulkowski is the author of Encyclopedia of Chart Patterns

2) Dan Zanger's Trader's Nation Weekly Audio Interview: This is an audio interview that is conducted every Wednesday morning with Dan and available all week in an archived form. I find it helpful to refocus my thoughts on the leaders in the market. In today's interview he mentioned AAPL, RIMM, MON, MOS, POT, CF, EXM, DRYS, MA and V.

Tuesday, June 3, 2008

IPI

Monday, June 2, 2008

May 2008 - Account Performance

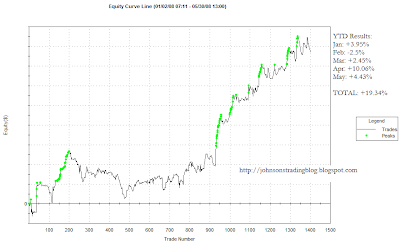

May was a tough month for me. As you can see in the chart below I started out pretty well, moved sideways for a bit only to then have a great string of winning trades which was then followed by a poor end to the month.

May 2008 Equity Curve:

I've consistently struggled with trading after a run of success. As soon as I get comfortable making money with certain sized trades I inevitably try to ramp up my size, and this of course leads to emotion which does NOT help my returns.

To combat the size problems my goal for June is to start real slow, stay at normal to less than normal sized trades and work my way to a consistent and profitable month with a higher return than the 4.43% I achieved in May.

Some statistics for May:

295 trades, 45.42% of them were profitable

Long trades: 152 trades, 74 profitable for 48.68%

Short trades: 143 trades, 60 profitable for 41.96%

Despite less than 50% of both my long and short trades being profitable in May I found a way to make money both long and short as long trades accounted for 60.4% of my portfolio gains and short trades accounted for 39.6%. Despite the gains my percentage of profitable trades were well below my year to date numbers, especially on the short side (YTD: 53% profitable). This is something I'd like to improve on in June.

YTD Results (through May 31):

Jan: +3.95%

Feb: -2.5%

Mar: +2.45%

Apr: +10.06%

May: +4.43%

TOTAL: +19.34%

Year To Date Chart:

May 2008 Equity Curve:

I've consistently struggled with trading after a run of success. As soon as I get comfortable making money with certain sized trades I inevitably try to ramp up my size, and this of course leads to emotion which does NOT help my returns.

To combat the size problems my goal for June is to start real slow, stay at normal to less than normal sized trades and work my way to a consistent and profitable month with a higher return than the 4.43% I achieved in May.

Some statistics for May:

295 trades, 45.42% of them were profitable

Long trades: 152 trades, 74 profitable for 48.68%

Short trades: 143 trades, 60 profitable for 41.96%

Despite less than 50% of both my long and short trades being profitable in May I found a way to make money both long and short as long trades accounted for 60.4% of my portfolio gains and short trades accounted for 39.6%. Despite the gains my percentage of profitable trades were well below my year to date numbers, especially on the short side (YTD: 53% profitable). This is something I'd like to improve on in June.

YTD Results (through May 31):

Jan: +3.95%

Feb: -2.5%

Mar: +2.45%

Apr: +10.06%

May: +4.43%

TOTAL: +19.34%

Year To Date Chart:

Sunday, June 1, 2008

Dan Zanger Interview

I've learned quite a bit from Dan Zanger in the near one year that I've been a member of his chat room. He has a unique style of trading in which he focuses solely on the best stocks (strongest EPS Growth) in the leading sectors. He'll often own only 3-7 stocks at a time and seems to have the great majority of his money in only 1-2 of those names.

Below is a three part interview iTV conducted with him from Jan 8, 2005. The 3 videos total about 23 minutes in length.

In the interview he notes among other gems that his biggest single lesson of 2005 was:

Link: Zanger's Website - Chartpattern.com

Below is a three part interview iTV conducted with him from Jan 8, 2005. The 3 videos total about 23 minutes in length.

In the interview he notes among other gems that his biggest single lesson of 2005 was:

"Not to be in the market all the time and to trade far less than I do, far less. I really have found that the market may have 2 big moves during the year and they may last 6, 8, 10, 12 weeks and other than that they just exhaust themselves after that. And really the rest of the time the market is just consolidating the gains. The big lesson for me this year has just been to trade less, trade less, trade fewer stocks, own just about 4 stocks that are really powerhouse stocks when the market bottoms out. Then the market will take off and run for maybe 10, 12, 13, 14 weeks, whatever it does and then trade out and go to golf, go to swimming, go to cash, just have fun and enjoy and wait for everything to setup and do it again. It takes about 4-5 months for everything to set up again."

Link: Zanger's Website - Chartpattern.com

Saturday, May 31, 2008

Johnson's Trading Blog

I'm going to take a cue from Chris Perruna's great blog and ask you to please take a moment to subscribe to my RSS feed and / or receive my posts via email if you haven't already done so. Both are free and allow my content to come to you, instead of you having to come to it. Click on the orange icon or enter your email address in the field and click "Subscribe" to get my daily posts in your RSS reader or email inbox.

I also highly recommend Google Reader. I've been using Google's Reader for well over a year now and it allows me to fairly easily read well over 100+ market related blogs every day with very little effort. You'll also notice that I share a number of my favorite posts that I come across; these are visible to you on the right hand sidebar of my page, just underneath the Twitter updates and just above my list of favorite trading sites.

Here is a brief video I found on Google Reader for those of you who aren't as familiar with RSS or Google Reader:

I also highly recommend Google Reader. I've been using Google's Reader for well over a year now and it allows me to fairly easily read well over 100+ market related blogs every day with very little effort. You'll also notice that I share a number of my favorite posts that I come across; these are visible to you on the right hand sidebar of my page, just underneath the Twitter updates and just above my list of favorite trading sites.

Here is a brief video I found on Google Reader for those of you who aren't as familiar with RSS or Google Reader:

Friday, May 30, 2008

Thursday, May 29, 2008

SPY Divergence

GOOG - Using multiple time frames to increase your risk / reward

GOOG today is a great example of how I like to use shorter termed time frames to enter swing trades.

By entering a trade using the 1 min bars (on the left) I'm able to cut my risk down substantially. In this case I like GOOG above 580 on the daily, as it is trying to break out of the little flag it has been forming. Entering on the 1 min gives me very little risk for what looks like it could be 600ish upside in the very near term (a few days)

Wednesday, May 28, 2008

Trader Interview

I had the pleasure of being interviewed by Tim Borquin for the Trader Interview series last week. The interview has been posted to the site today so give it a listen and I'd love to hear your comments. I hate both the sound of my voice and how inarticulate I am at times so hopefully it isn't too painful.

Give it a listen at: Johnson's Trader Interview

Give it a listen at: Johnson's Trader Interview

Friday, May 23, 2008

LEH Short

Thursday, May 22, 2008

Ominous Data Point for the Nasdaq: Net New Highs

From Rob Hanna's excellent Quantifiable Edges Blog:

Click through to his blog to see just how well you'd have done going short on those three dates.

Link: Rob Hanna's Quantifiable Edges

"Since early April the Nasdaq has been a leading index. Net new highs have failed to expand, though. According to my data provider, they peaked at 64 on May 2nd. The last few days there have been significantly more new lows than new highs. If you take the net difference and divide it by the number of stocks trading on the Nasdaq your result for Tuesday and Wednesday was less than -1%. (Wednesday: 53 new highs – 93 new lows = -40 net / 3030 issues = -1.32%). Coming off a 4-month (80 day) high this is an unusual occurrence.

I looked back to 1994 (as far back as I had the data) to see if I could find other times where the Net New High Percentage ratio closed below -1% twice within 3 days of an 80-day high. I found three other dates 7/23/98, 7/20/07, and 11/02/07."

Click through to his blog to see just how well you'd have done going short on those three dates.

Link: Rob Hanna's Quantifiable Edges

Wednesday, May 21, 2008

AAPL - break of the 20 day

Monday, May 19, 2008

MON - Great example of my favorite type of trade right now

Below is a trade that I unfortunately missed today. It's a great representation of my FAVORITE type of trade - shorting into resistance. These work great because there is big upside and little risk. Short it at 125 and use a mental stop above the HOD at 125.27. MON had struggled to get and stay over 125 this last week so there was a good chance it'd fail again. A little patience and a convenient market sell off and 3 points would have been made with about .30 of risk.

Friday, May 16, 2008

MBT Follow-up

MBT was up over 5% today as it broke through the declining tops line (in white) I referenced in a post a couple of days ago. I held a position for most of the day, sold it near 80 and then bought back a 1/2 position just a minute before the close. My main concern at this point is the yellow channel. I love how the stock is acting so clearing that channel solidly to the upside will have me back to a full position.

Thursday, May 15, 2008

PKX - Follow Up

POSCO (PKX) has broken out as I thought it would. Unfortunately for me, it went without me as I was waiting on the volume to come in. In retrospect I should have picked up 1/2 a position or so when it broke through as there was a good likelihood that the volume would eventually come and when it did it'd ramp. The stock is in no man's land now so I have to wait for a bit of a base or a pullback before getting in at this point.

Wednesday, May 14, 2008

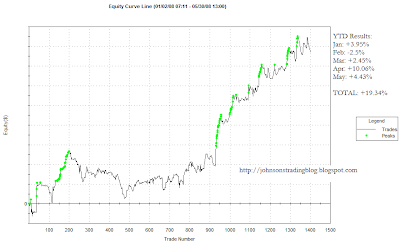

Trading Performance - Stepping Up the Accountability

Pasted below are charts of my trading account's equity curve. A year-to-date chart and a separate chart for each month are included. In posting these charts I'm looking to address one thing: Accountability.

There are two facets of accountability at work here. First, accountability to the reader. I'd love to see portfolio metrics on every trading blog I come across. I want to know if the person posting is full of it or not. So to you, my 9 faithful readers, I'll be offering up my equity curve. You'll be able to tell if I'm trading like crap and you are crazy to listen to me, or if I'm doing unbelievably well and everything I am touching is turning to gold.

The second facet of accountability is to myself. I'm an exceptionally competitive person and placing my results here for the world to see is very likely to cause me to have a much smoother equity curve than I have had in the past. 2007 was a year where I experienced massive gains, only to lose them towards the end of the year. I won't let that happen in 2008 and if placing my results on the internet for all to see plays a small part in that then I'm all for it.

Year-to-date Performance +17.44%:

January 2008 Performance +3.95% (+3.95% YTD):

February 2008 Performance -2.5% (+1.34% YTD):

March 2008 Performance +2.45% (+3.83% YTD):

April 2008 Performance +10.06% (+14.27% YTD):

April 2008 Performance +10.06% (+14.27% YTD):

May 2008 (May 1 - May 14) Performance +2.78% (+17.44% YTD):

There are two facets of accountability at work here. First, accountability to the reader. I'd love to see portfolio metrics on every trading blog I come across. I want to know if the person posting is full of it or not. So to you, my 9 faithful readers, I'll be offering up my equity curve. You'll be able to tell if I'm trading like crap and you are crazy to listen to me, or if I'm doing unbelievably well and everything I am touching is turning to gold.

The second facet of accountability is to myself. I'm an exceptionally competitive person and placing my results here for the world to see is very likely to cause me to have a much smoother equity curve than I have had in the past. 2007 was a year where I experienced massive gains, only to lose them towards the end of the year. I won't let that happen in 2008 and if placing my results on the internet for all to see plays a small part in that then I'm all for it.

Year-to-date Performance +17.44%:

January 2008 Performance +3.95% (+3.95% YTD):

February 2008 Performance -2.5% (+1.34% YTD):

March 2008 Performance +2.45% (+3.83% YTD):

April 2008 Performance +10.06% (+14.27% YTD):

April 2008 Performance +10.06% (+14.27% YTD):

May 2008 (May 1 - May 14) Performance +2.78% (+17.44% YTD):

Labels:

Accountability,

Equity Curve,

Performance

Subscribe to:

Comments (Atom)